Education Loan

Home - Education Loan

Make an Appointment

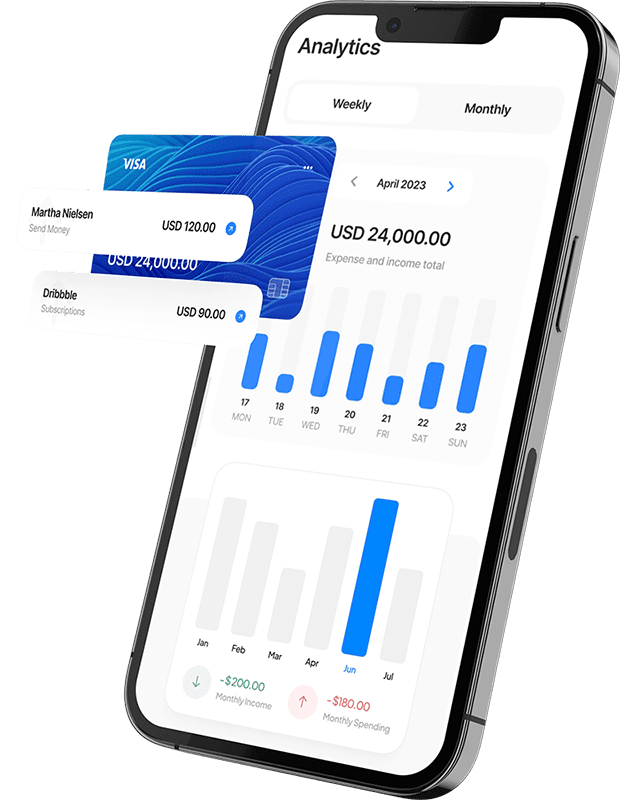

Get Your Education Loan Today!

Get your education loan today and pave the way for a brighter future! Our streamlined process ensures that you can access the financial support you need to pursue your academic goals.

- Our user-friendly application process makes obtaining an education loan a hassle-free experience.

- We understand the importance of affordable financing for your education.

- We believe in empowering students to succeed without compromising their financial well-being.

Education Loan

What is a Education Loan?

An education loan is a financial tool that helps individuals cover the costs of higher education, including tuition fees and living expenses. Offered by banks and financial institutions, these loans typically come with reasonable interest rates and flexible repayment options.

Read More...

They enable students to pursue academic programs without immediate financial strain, with repayment typically starting after course completion. Education loans play a vital role in making higher education more accessible, supporting individual aspirations and societal development.

They enable students to pursue academic programs without immediate financial strain, with repayment typically starting after course completion. Education loans play a vital role in making higher education more accessible, supporting individual aspirations and societal development.

Eligibility Criteria for Education Loan

Eligibility

Education loan eligibility usually requires admission to a recognized institution, approval of the course and college, Indian nationality, and adherence to an age limit. A co-applicant or guarantor, collateral, and a good credit history are often necessary.

Qualification

Pursuing graduate/postgraduate degree or a PG diploma.

Income source

Parents/Guardians

University Applied to

Recognised – In India/Abroad

Loan Amount

Get loans up to 10 Lakhs, determined by your credit score

Admission Status

Confirmed

Security

Tangible collateral or guarantor- depending on the loan amount and income source.

Minimum Interest Rate

8.30% p.a.

Document Required

To apply for an education loan, prospective borrowers typically need to submit a set of essential documents to the lending institution.

Proof of Identity

- Duly filled in and signed application form / Two photographs / Copy of exam mark sheets of 10th / 12th or latest education certificate / Statement of course expenses / Aadhaar Card and Pan Card of the student and Parent

Proof of Income

- salary slips or Form 16 of the parent/ guardian/co-borrower

Proof of Address

- Rental agreement / Bank statement of 6 months of the student or co-borrower / Guarantor / Copy of Ration card / Gas Book / Electricity Bill / Tel Bill

Proof of Age

- Copy of Aadhaar Card / Voter ID / Passport / Driving Licence

Why Choose Us

We Provide Education Loan with

Transparency

We take pride in offering education loans with a commitment to transparency. With a focus on openness and clarity, our education loan process is designed to provide a seamless experience for applicants.

Transparent Terms and Conditions

We believe in open communication and ensure that our borrowers fully comprehend the terms and conditions of their education loans.

Competitive Interest Rates

Our commitment to fostering education extends to offering competitive interest rates.

Dedicated Support and Guidance

We go beyond just providing loans; we offer personalized support and guidance throughout the loan process.

Apply Now

To get a personal loan, fill out the below from and get the amount in account.

FAQ

You Can Find All Answers Here

Lenders consider factors such as credit history, academic performance, chosen course, and the reputation of the educational institution.

Yes, lenders may levy a processing fee on education loans, which covers the administrative costs associated with the loan application.

It depends on the terms and conditions set by the lender. Some lenders may allow the conversion from a fixed rate to a floating rate, but it's advisable to check with the specific lender for their policies.