Business Loan

Home - Business Loan

Make an Appointment

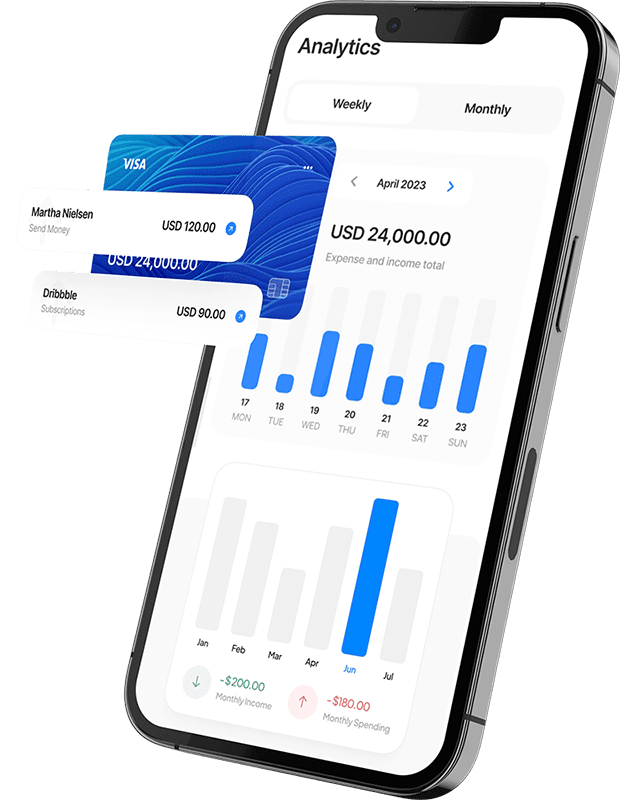

Get Your Business Loan Today!

CRDTLIN Capital offers business loans to help entrepreneurs and business owners achieve their financial goals.

- Applying for a loan is quick and easy with us, saving businesses time and effort.

- Enjoy affordable financing with us, thanks to their competitive interest rates.

- We provide personalized loan options to meet the specific needs of each business, whether it's for working capital or expansion.

Business Loan

What is a Business Loan?

A business loan is a financial arrangement where a lender provides funds to a business for operational needs, expansion, or other purposes. It supports cash flow, equipment acquisition, inventory, and strategic initiatives.

Read More...

Loans have predetermined terms, interest rates, and repayment schedules, with collateral or unsecured options based on creditworthiness. Lenders evaluate factors like financial health, credit history, and future projections. Business loans are vital for enterprises to capitalize on growth opportunities, navigate financial challenges, and ensure overall stability and success.

Loans have predetermined terms, interest rates, and repayment schedules, with collateral or unsecured options based on creditworthiness. Lenders evaluate factors like financial health, credit history, and future projections. Business loans are vital for enterprises to capitalize on growth opportunities, navigate financial challenges, and ensure overall stability and success.

Eligibility Criteria for Personal Loan

Eligibility

Business loan eligibility requires a good credit score, 1-2 years of business operation, stable financials, a solid business plan, and potential collateral. Compliance with legal regulations, a clear loan purpose, and consideration of ownership structure and industry type are also crucial. Meeting these criteria enhances loan approval prospects.

Work Experience

Work experience criteria for a business loan involve evaluating the applicant’s professional background. Lenders assess the number of years in the industry, leadership roles, and past successes, indicating the borrower’s ability to manage the business and meet loan obligations.

Credit Score

Above 750

Age

18 – 60/65 years

Loan Amount

Get loans up to 10 Cr, determined by your credit score

Minimum Business Vintage

3 years (may be 5 years for some lenders)

Minimum Business Turnover

Rs 90,000 to more than Rs 250 crore

Eligible Entities

MSMEs, Proprietors, Limited Liability Partnership firms, Private Limited Companies, Public Limited Companies, self-employed individuals, self-employed professionals (doctors, CA, CS, architect, etc.) individual corporations, etc.

Document Required

To get a business loan, you'll need to provide key documents like your business plan, financial statements, tax returns, and bank statements.

Proof of Identity

- PAN Card / Voter ID / Aadhaar Card / Passport / Driving License

Proof of Income

For Self Employed Individuals:

- ITR / P&L Statement and Balance Sheet / Bank Account Statement

Proof of Firm Constitution

- MOA/PartnerShip Deed/GST Registration Certificate

Proof of Address

- Bank Account Statement / Aadhaar Card / Lease Documents / Property Purchase Agreement / Utility Bill / Passport / Driving License

Proof of Age

- Birth certificate, PAN card, Aadhar card, Passport

Proof of Ownership proof

- Agreement Copy / Electricity Bill / Maintenance Bill with share certificate / Municipal tax bill/Share certificate

Proof of Business continuity proof

- Shop and Establishment certificate/Tax registrations-VAT/Service tax/GST registrations

Why Choose Us

We Provide Business Loan with

Transparency

CRDTLIN Capital understands the importance of clarity and openness in financial transactions.

Clear Terms and Conditions

Our business loan offerings come with straightforward terms and conditions.

Transparent Interest Rates

We believe in fair and transparent

pricing

Open Communication Channels

We prioritize open communication with our clients.

Apply Now

To get a personal loan, fill out the below from and get the amount in account.

FAQ

You Can Find All Answers Here

Getting a business loan without ITR may be challenging, as most lenders require income tax returns as a key financial document.

The minimum turnover requirement for a business loan varies among lenders, but it is typically based on the size and nature of your business. Check with specific lenders for their criteria.

Documents required for a business loan for a doctor may include proof of identity, address, medical degree, registration certificate, financial statements, and business ownership details. Check with the lender for specific requirements.