Loan Against Property

Home - Loan Against Property

Make an Appointment

Get Your Loan Against Property Today!

Loan against property (LAP) is a secured loan option where individuals can leverage their owned real estate assets to secure funds for various financial needs.

- Loan against property is a secured loan, wherein the borrower pledges their property (residential or commercial) as collateral.

- One of the significant advantages of loan against property is its versatility in utility.

- Loan against property typically offers longer repayment tenures compared to unsecured loans.

Loan Against Property

What is Loan Against Property?

A Loan Against Property (LAP) is a secured loan where a borrower pledges their residential or commercial property as collateral to obtain funds from a financial institution. The loan amount is determined based on the property's value. Interest rates are typically lower than unsecured loans, and the repayment period can range from 5 to 15 years.

Read More...

The funds can be used for various purposes, and eligibility is based on factors like property value, income, and creditworthiness. Defaulting on the loan poses the risk of losing the pledged property. Borrowers should carefully review terms and conditions before availing such a loan.

The funds can be used for various purposes, and eligibility is based on factors like property value, income, and creditworthiness. Defaulting on the loan poses the risk of losing the pledged property. Borrowers should carefully review terms and conditions before availing such a loan.

Eligibility Criteria for Loan Against Property

Eligibility

The documents required for a Loan Against Property (LAP) application in simple terms. It includes property papers like title deeds and valuation reports, along with personal financial documents such as income proof and ID. Submitting these documents accurately is crucial for a smooth LAP application process, enabling individuals to use their property for diverse financial needs.

Work Experience

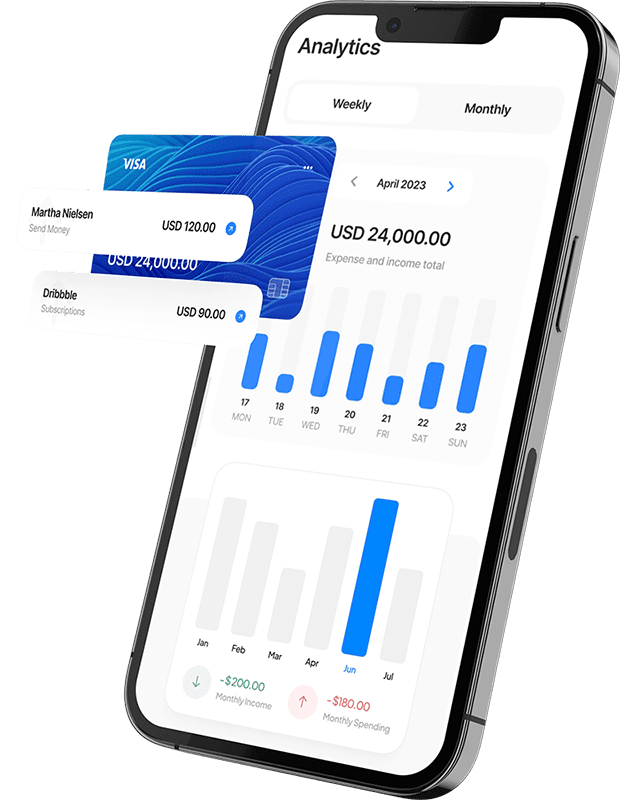

Our customized solutions give you the freedom to use the value of your property for various financial needs. Whether you want to grow your business, support education, or achieve personal financial goals, our options can help. Enjoy good interest rates, easy repayment choices, and a simple application process that makes getting funds based on your property easy and efficient.

Credit Score

Above 750

Age

18 – 70 years

Loan Amount

Get loans up to 1Cr, determined by your credit score

Employment Stability

At least 1 year in the current organization

LTV Ratio

Up to 90% of property value

Employment Type

Salaried, Self-employed Professional and Self-employed Non-Professional

Net Annual Income

At least Rs. 1.5 lakh p.a.

Property Type

Homes, shops, and factories can be used as security when taking a loan. The bank will check how old and well-maintained the property is before agreeing to accept it as security.

Document Required

To secure a Loan Against Property, submit essential documents such as ID proof, address proof, income statements, property papers, and financial records.

Proof of Identity

- PAN Card / Voter ID / Aadhaar Card / Passport / Driving License

Proof of Income

For Salaried :

- Form 16, Latest Payslips, ITR of past 3 years and investment proofs (if any)

For Self Employed Individuals:

- Details of ITR of last 3 years, Balance Sheet and Profit & Loss Account Statement of the Company/Firm, Business License Details and Proof of Business Address

Proof of Address

- Ration card/ Telephone Bill/ Electricity Bill/ Rental Agreement/ Passport/ Bank Passbook or Statement/ Driving License

Property-related Documents

- Title Deeds including the previous chain of the property documents, Nil Encumbrance Certificate on the concerned property, approved plan [if applicable]

Why Choose Us

We Provide Loan Against Property Loan with Transparency

Choose us for your Loan Against Property for a seamless experience with competitive rates, transparent processes, and flexible repayment options.

Competitive Rates

Choose us for Loan Against Property with competitive and transparent interest rates.

Flexible Repayment

Enjoy the flexibility of tailored repayment plans to suit your unique financial situation.

Quick Processing

Experience a hassle-free and speedy loan approval process for prompt disbursement.

Apply Now

To get a personal loan, fill out the below from and get the amount in account.

[forminator_form id="2107"]

FAQ

You Can Find All Answers Here

Yes, having a co-applicant is necessary for getting a Loan Against Property (LAP).

Lenders accept various types of properties like houses, flats, and commercial spaces for LAP.

The maximum loan tenure for Loan Against Property (LAP) depends on the lender, but it is typically around 15 to 20 years.