Personal Loan Transfer

Home - Personal Loan Transfer

Make an Appointment

Get Your Personal Loan Transfer Today!

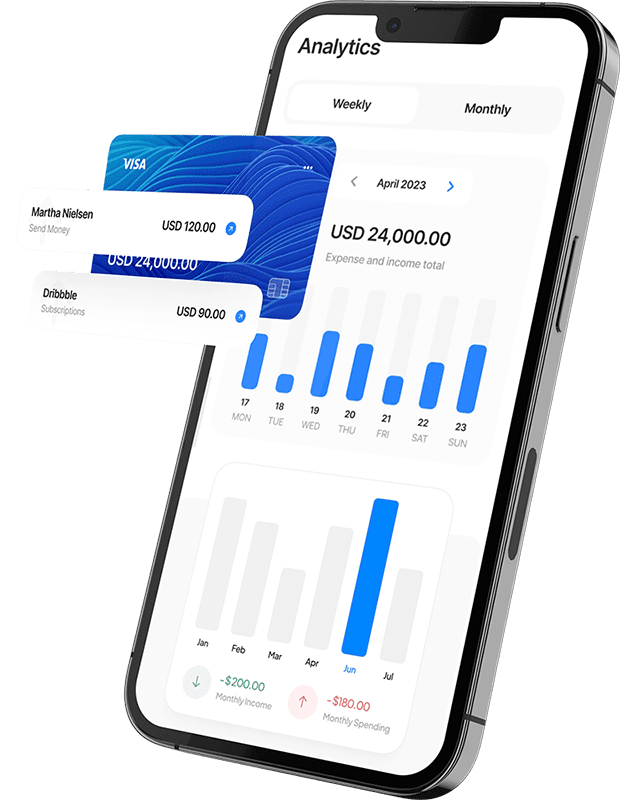

CRDTLIN Capital offers a seamless solution for transferring your personal loan, ensuring a hassle-free experience for individuals seeking financial flexibility.

- We prioritizes efficiency, facilitating swift personal loan transfers to help customers quickly access funds or better interest rates.

- Tailoring their services to individual financial requirements, We provide personalized solutions, ensuring that each client receives the most suitable loan transfer options.

- With a customer-centric focus, We prioritizes a positive experience for its clients, offering transparent communication and support throughout the personal loan transfer process.

Personal Loan Transfer

What is a Personal Loan Transfer?

Personal loan transfer refers to the process of shifting an existing personal loan from one financial institution to another. This option is typically exercised by borrowers seeking better terms, such as lower interest rates, improved repayment terms, or enhanced customer service.

Read More...

By transferring a personal loan, individuals aim to reduce the financial burden associated with their existing loan and potentially save on overall interest costs. It involves closing the existing loan with the current lender and opening a new one with a different lender who offers more favorable conditions. However, it's crucial for borrowers to carefully evaluate the costs, fees, and benefits associated with the transfer to ensure that it indeed leads to a more advantageous financial arrangement.

By transferring a personal loan, individuals aim to reduce the financial burden associated with their existing loan and potentially save on overall interest costs. It involves closing the existing loan with the current lender and opening a new one with a different lender who offers more favorable conditions. However, it's crucial for borrowers to carefully evaluate the costs, fees, and benefits associated with the transfer to ensure that it indeed leads to a more advantageous financial arrangement.

Eligibility Criteria for Personal Loan Transfer

Eligibility

Eligibility for a personal loan transfer depends on factors such as a good repayment history, a high credit score, stable income, employment continuity, a favorable debt-to-income ratio, and proper documentation.

Work Experience

Experienced in personal loan transfers, adept at managing financial processes and customer relations. Skilled in facilitating smooth transitions between financial institutions, evaluating loan applications, and ensuring compliance.

Credit Score

Above 750

Age

18 – 60/65 years

Loan Amount

Existing outstanding loan amount should be at least Rs. 50,000 or defined by the lender

Employment Stability

Usually 1 year of work experience is required with some lenders requiring longer work experience

Document Required

When initiating a personal loan transfer, several documents are typically required to facilitate the process smoothly.

Proof of Identity

- PAN Card / Voter ID / Aadhaar Card / Passport / Driving License

Proof of Income

For Salaried Professionals:

- Last 6 months’ bank statement / Salary slip for last 3 months / Statement of personal loan from a current lender

For Self Employed Individuals:

- Business PAN card / Business address and vintage proofs / Last 3 years’ Balance sheet / Last 6 months’ bank statement of individual and business entity / Statement of personal loan from a current lender

Proof of Address

- PAN card/driving license/passport/voter ID/Aadhaar Card, etc

Proof of Bussiness

- Certificate of Practice / Partnership Deed / GST Registration and Filing Documents / MOA & AOA / Shop Act License

Why Choose Us

We Provide Personal Loan Transfer with

Transparency

We is a financial institution dedicated to providing personalized personal loan transfer services with a commitment to transparency. With a focus on meeting the unique financial needs of individuals, CRDTLIN Capital ensures a seamless and efficient loan transfer process.

Seamless Personal Loan Transfers

We ensure a smooth and hassle-free process for transferring personal loans.

Commitment to Transparency

Transparency is a core value at CRDTLIN Capital. They believe in open communication and clarity throughout the loan transfer process.

Flexible and Competitive Terms

We offer flexible and competitive terms for personal loan transfers.

Apply Now

To get a personal loan, fill out the below from and get the amount in account.

FAQ

You Can Find All Answers Here

Yes, in many cases, personal loans can be transferred to another bank or financial institution through a process known as loan balance transfer. This allows you to shift your outstanding loan amount to a different lender, often with the potential for lower interest rates and better terms.

Common reasons for transferring a personal loan include obtaining a lower interest rate, reducing monthly payments, consolidating multiple loans into a single payment, or accessing additional features and benefits offered by another lender.

Yes, there may be charges involved in transferring a personal loan, such as processing fees, prepayment penalties, or administrative charges. It's crucial to carefully review the terms and conditions of the new loan and assess the overall cost implications before deciding to transfer your personal loan.